The future

of glass recycling

The future of glass recycling

We have to admit, we’ve got a crush on glass! It’s an amazing material, right? Not least because unlike other materials it can be infinitely recycled. But it’s also a challenging material for hospitality venues that have to manage the removal and disposal of it.

So, in 2002 we invented the BottleCycler glass bottle crushing machine – the first of its kind in Australia and still the market leader. It’s small and quiet enough to sit behind the bar, yet mighty enough that it can crush up to 80 glass bottles a minute.

Our goal is to take the pain out of glass management and recycling, and lead the resource revolution for glass – working towards a world where no glass is wasted.

That’s why, every glass bottle that goes through a BottleCycler machine gets recycled back into a new glass container again! That means that not only is BottleCycler better for your bottom line and safer for your staff – it’s also better for the planet.

All you do is put in the empties,

…and we take care of the rest!

ABOUT BOTTLECYCLER

BottleCycler is the glass recycling experts to the hospitality industry. We invented the first Australian bottle crushing machine back in 2002 and we’re proud to still be the market leader nearly 20 years later.

Why? Because we’re passionate about glass and recycling. And as part of global resource management company TOMRA, we believe sustainability is everyone’s business.

Our aim is to provide a full–service glass management and recycling solution backed up by superior customer service and an uncompromising commitment to safety. Our solution is proven to be better for your bottom line, better for your people and better for the planet.

Our 800+ clients around Australia, have saved millions of kilos of glass from landfill. We work with restaurants, bars and event venues Australia-wide to make the world a cleaner, safer, and more sustainable place. Our mission is to see a world where no glass is wasted – and glass is seen as a resource, not as waste that ends up in landfill.

Put simply – we lighten your load and bring peace of mind, so you can focus on your business while doing the right thing by the environment.

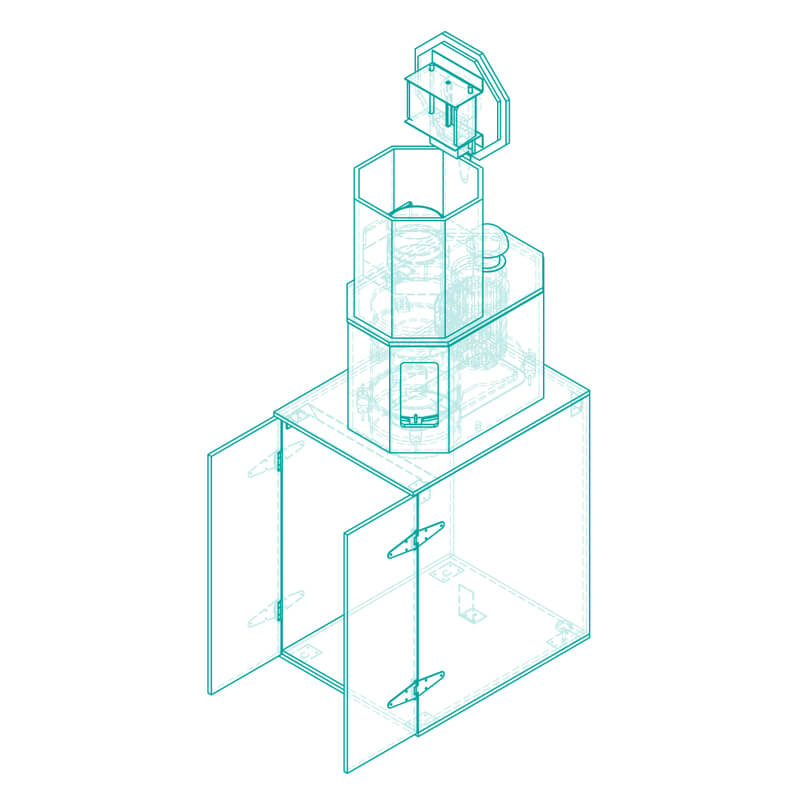

OUR MACHINE

Swift and efficient, our glass crushing machine is designed to sit quietly behind your bar and can crush up to 80 bottles per minute.

In so doing, it reduces the original volume of the glass by up to 80%, so you can store up to five times the number of bottles in the same amount of space! That’s up to 300 beer bottles or 200 wine bottles in every BottleCycler bin.

How does it work? Simply feed the empty glass bottles into the top. The bottles will be instantly (and quietly) crushed into the easily manageable 60 litre bin that sits below.

Our machine’s smart safety features will let you know when it’s full. From here, simply attach the ergonomic handle to the bin and wheel it to the collection point. It’s that easy. No tipping, no heavy lifting.

Click here to view / download the latest BottleCycler information brochure.

LATEST NEWS

Maximising Space Efficiency with BottleCycler

When it comes to the hustle and bustle of Australian hospitality venues, space is always one of the most important commodities. There are all kinds of demands on a venue’s capacity: customers, storage, prep, service, [...]

Navigating Legal and Environmental Glass Recycling Requirements for Your Venue

When it comes to running a successful Australian hospitality venue in 2024, there’s more to consider than ever before about how venue operations can either positively or negatively contribute to your environmental footprint. As more [...]

Glass Recycling Myths Debunked

As Australia works towards greater environmental sustainability goals, glass recycling plays a pivotal role. Unfortunately, misconceptions and myths surrounding this process can reduce the impact of glass recycling efforts, leading recyclable glass to end up [...]